Copper-Clad Laminate Industry Sees Wave of Production Expansion; Domestic Substitution of Core Materials Accelerates

2026-01-27

"Based on our recent understanding, the copper-clad laminate industry is entering a new cycle of prosperity. Some companies are not even shutting down for the Chinese New Year holiday," said a senior executive from a well-known domestic phenolic resin company to a Securities Times reporter on January 25th. "In the process of the rise of the domestic CCL industry, the domestic substitution of core materials is expected to accelerate."

Companies Ramp Up Production of High-Performance CCLs

Copper-Clad Laminate (CCL) is a major application field for phenolic resin. The downstream CCL clients of the aforementioned phenolic resin company include Taiwan Union Technology Corporation, ITEQ, Shengyi Technology (600183), Huazheng New Material (603186), Jin'an Guojie (002636), and Nan Ya New Material (688519), among others.

"With the rapid growth in demand from AI servers, automotive electronics (885545), and optical communication, CCL companies are experiencing a recovery. We recently returned from a visit to a CCL company; they are quite optimistic about the 2026 outlook. Due to urgent customer orders, they are not planning to shut down for the Spring Festival," the executive added.

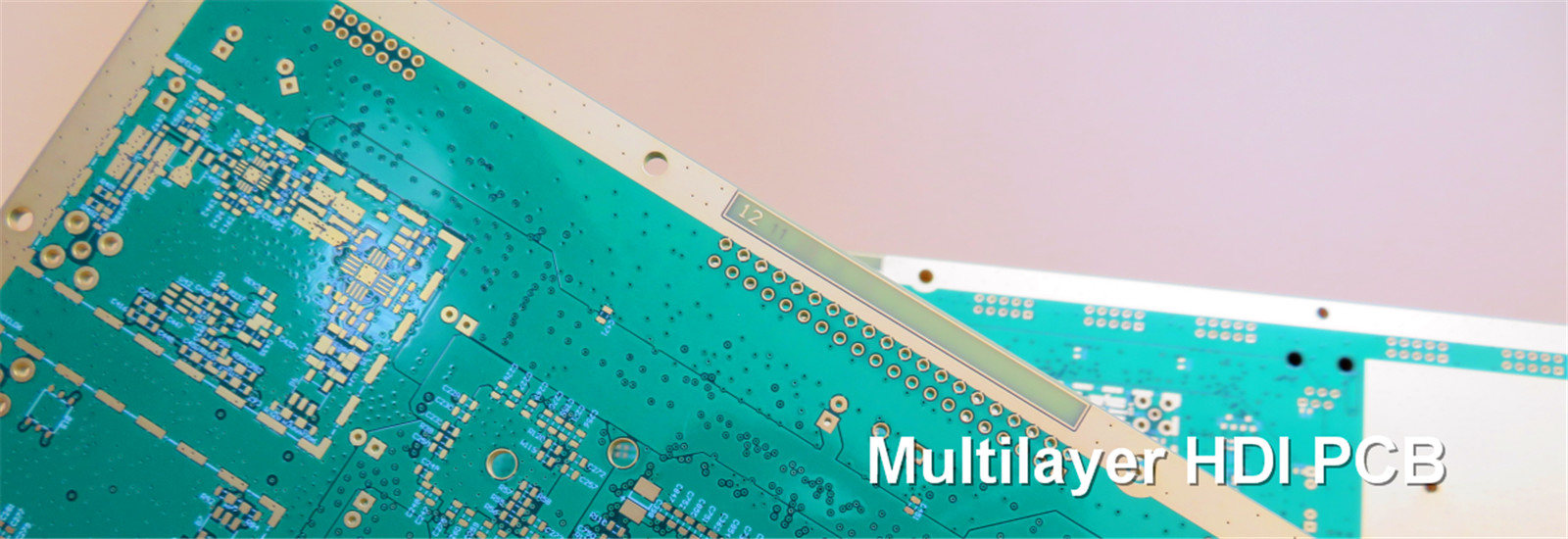

It is understood that CCL is the upstream material for manufacturing PCBs (Printed Circuit Boards (884092)), with final application scenarios including communication equipment (881129), automotive electronics (885545), consumer electronics (881124), and semiconductors (881121), etc. In the next 3-5 years, the growth in the PCB industry will be primarily driven by the dual engines of "AI computing infrastructure + automotive electronics (885545) intelligence." Simultaneously, advanced packaging (886009), edge AI hardware, high-frequency communication, and other fields will provide structural growth opportunities. The trend of the industry upgrading towards higher-end, high-value-added products is clear.

Recently, due to a surge in AI server demand causing tight supply of high-end raw materials, global leader Resonac has announced a comprehensive price increase of over 30% for materials including Copper Foil Substrates (CCL), effective from March 2026. With the surge in demand from AI servers and new energy vehicles (850101), the global PCB market reached $88 billion in 2024. According to forecasts by consultancy Prismark, the global PCB market output value will grow by approximately 6.8% in 2025, and the PCB industry will continue to grow in the coming years, reaching around $94.661 billion by 2029, with a compound annual growth rate (CAGR) of about 5.2%.

In terms of global capacity distribution, China has become the absolute leader, accounting for about 50% of global PCB capacity. The Pearl River Delta (Guangdong accounts for 40% of national capacity), Yangtze River Delta, and Bohai Rim form the three core manufacturing belts. Driven by cost factors, Southeast Asia (513730) has undertaken the transfer of some mid-to-low-end PCB capacity.

Those closest to the water know the temperature first. The reporter noted that after a prolonged downturn of 2-3 years, upstream CCL companies are experiencing a strong recovery and have been reporting positive results in their annual performance forecasts. For example, Jin'an Guojie (002636) reported net losses after deducting non-recurring items of 110 million yuan and 82.36 million yuan in 2023 and 2024, respectively. However, by the second half of 2025, the company's performance accelerated, with full-year net profit expected to increase by 655.53%—871.4%. Huazheng New Material (603186) forecasts a net profit of 260-310 million yuan for 2025, compared to a net loss after deducting non-recurring items of 119 million yuan in the previous year. Nan Ya New Material (688519) reported a net profit of 158 million yuan for the first three quarters of 2025, exceeding the full-year profit of 50.32 million yuan from the previous year. Industry leader (883917) Shengyi Technology (600183) reported a net profit of 2.443 billion yuan for the first three quarters of 2025, already surpassing the full-year 2024 net profit of 1.739 billion yuan.

It is noteworthy that while collectively reporting positive annual results, CCL companies have also successively announced new rounds of production expansion. On January 4th, Shengyi Technology (600183) disclosed that it has signed a 4.5 billion yuan investment intent agreement for a high-performance CCL project with the Dongguan Songshan Lake High-Tech Industrial Development Zone Management Committee. In December 2025, Nan Ya New Material (688519) disclosed a private placement plan, intending to raise approximately 900 million yuan to expand production of high-end CCLs. In November 2025, Jin'an Guojie (002636) disclosed a private placement plan, intending to raise 1.3 billion yuan for projects including high-grade CCLs.

Core Materials Accelerating Domestic Substitution

In the new round of expansion within the CCL industry, upstream core material suppliers are expected to accelerate domestic substitution. "In recent years, many domestic high-end resins and their core materials have made significant progress in product performance enhancement and are now able to substitute for foreign counterparts on an equal footing," the aforementioned resin company executive stated. "Perhaps sensing the crisis of domestic substitution, Daihachi Chemical Industry (850102) recently approached our company, hoping we would become their agent for phosphorus-based flame retardants, but we declined."

The executive cited an example: "Currently, while producing resins, we are also the agent for two special phosphorus-based flame retardants from Wansheng Co., Ltd. (603010). Leveraging our company's existing channel advantages and the cost-effectiveness of Wansheng's own products, we have introduced their products to several CCL companies. Previously, the use of these special flame retardants by these companies was largely monopolized by foreign firms."

Regarding these statements, the reporter reviewed the company's public information and found that it has already deployed two core products in the high-end PCB upstream material field at its Weifang base: flame retardants for CCLs and photosensitive resins for PCB photoresists (885864). A representative from Wansheng Co., Ltd. (603010) told the reporter that the company has formed diversified supply capabilities for multiple types of flame retardants and photosensitive resins for CCLs, continuously solidifying its competitive advantage.

Benefiting from the continuous expansion of the downstream printed circuit board (PCB) manufacturing industry and increasing requirements for fire performance in electronic products, the global market demand for flame retardants used in epoxy CCLs is expected to show a rapid growth trend. Halogen-free phosphorus-based flame retardants, which can avoid harmful gases produced by halogen combustion and the potential carcinogenic risks associated with antimony-based flame retardants, and possess good thermal stability and flame retardant efficiency, are seeing a significantly increased application proportion in high-end CCLs.

It is understood that resin types involved include electronic-grade epoxy resins, electronic-grade phenolic resins, etc. Among them, electronic-grade resins act like "property adjusters" for CCLs—different resins can enhance different characteristics of CCLs, and the upgrading of CCL characteristics in turn makes PCB performance better. For example, the polar group structure and curing method of the resin affect the copper foil peel strength and interlayer bonding force of the CCL, making PCB processing more reliable. The more bromine-based or phosphorus-based flame-retardant elements in the resin, the higher the flame retardant rating of the CCL. Special structures can also achieve low dielectric properties and intrinsic flame retardancy, meeting the needs for high-frequency signal transmission and high-speed information processing, widely used in next-generation servers, automotive electronics (885545), communication networks, and other fields.

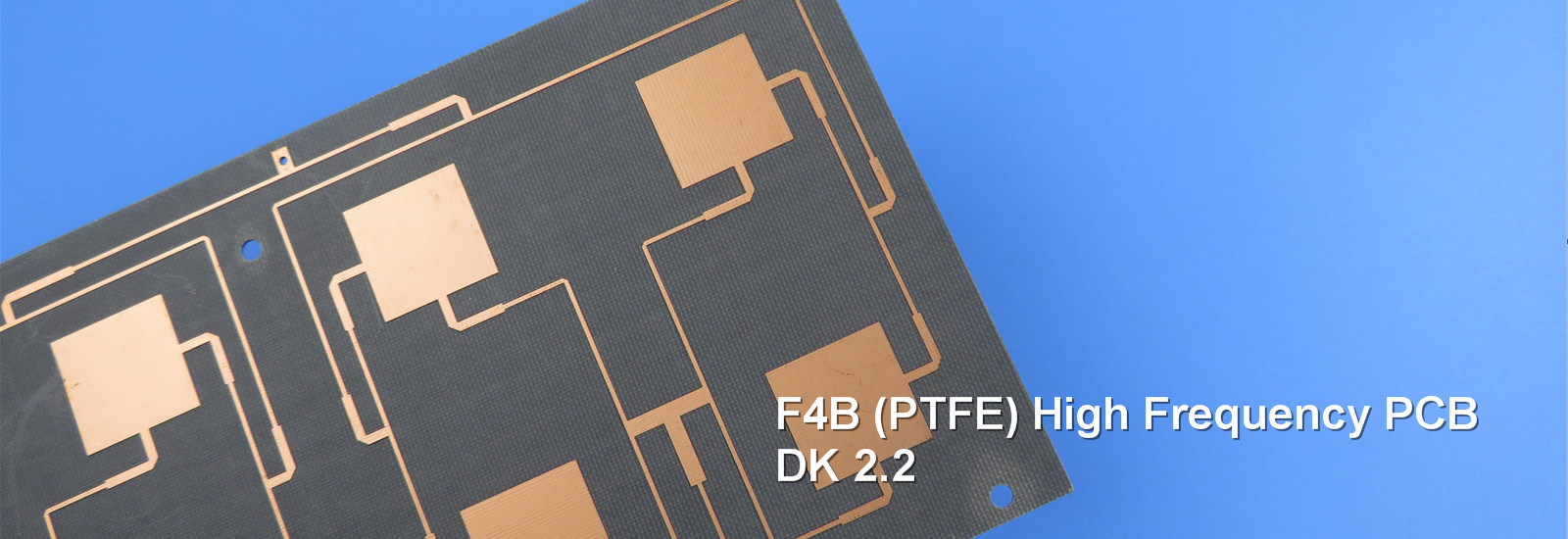

Taking high-frequency CCLs as an example, such products are "special receivers" for ultra-high-frequency signals, operating at frequencies over 5GHz, suitable for ultra-high-frequency scenarios. They require ultra-low dielectric constant (Dk) and as low as possible dielectric loss (Df). They are core materials for 5G base stations, autonomous driving (885736) millimeter-wave radars (886035), and high-precision satellite navigation (885574). To lower Dk, it mainly relies on modifying the insulating resin, glass fiber, and overall structure.

Industry insiders believe that as the global electronics industry upgrades towards "halogen-free, high-performance, high-reliability," the performance requirements for PCB upstream materials (especially flame retardants and CCLs) continue to increase, providing new market opportunities for material companies with technological advantages. These companies will gain first-mover advantages in the domestic substitution within the mid-to-high-end markets. In particular, Wansheng Co., Ltd. (603010), having laid out in advance the two core product lines of flame retardants for CCLs and photosensitive resins for PCB photoresists, will fully enjoy the benefits of industry growth and domestic substitution.

----------------------------------

Source: Securities Times e Company

Disclaimer: We respect originality and also value sharing; the copyright of text and images belongs to the original author. The purpose of reprinting is to share more information, which does not represent the position of this account. If your rights are infringed, please contact us promptly, and we will delete the content as soon as possible. Thank you.

View More

What is MSL? A Guide to Moisture-Proof Storage in PCB SMT Workshops

2026-01-27

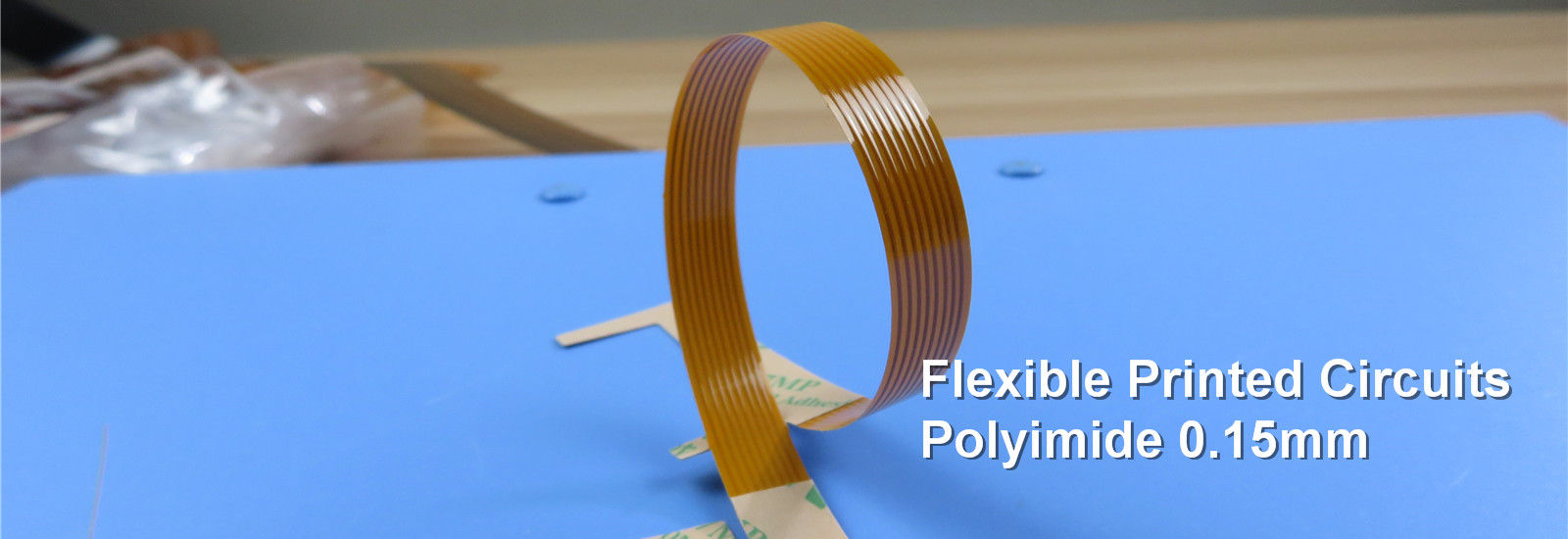

In the SMT (Surface Mount Technology) production process, moisture sensitivity issues with PCBs and components directly affect soldering yield and product reliability. The Moisture Sensitivity Level (MSL) is the core indicator for defining protection standards. Coupled with standardized workshop storage conditions, it can effectively prevent production failures caused by moisture absorption. Why are PCBs afraid of moisture? What is the MSL rating?

PCB substrates (such as FR-4) easily absorb moisture from the air. During the high temperatures of SMT reflow soldering (>220°C), internal moisture rapidly vaporizes and expands, which may lead to board delamination or micro-cracks in solder pads (known as the "popcorn" effect), resulting in electrical failure. The industry uses the Moisture Sensitivity Level (MSL) standard to quantify this risk, divided into levels 1–6. The higher the number, the more sensitive the component, and the shorter the allowable workshop exposure time:

MSL Level 3: Must be soldered within 168 hours (7 days) after opening.

MSL Level 6: Must be soldered within 24 hours and often requires baking for moisture removal before use.

Storage and management specifications in SMT workshops are based on MSL requirements. Modern SMT workshops must establish a strict moisture-sensitive material control system:

Incoming Storage: Clearly label materials with their MSL level and store them separately. Standard materials are stored in a controlled environment (typically temperature

View More

Choosing PCB Materials: Metal Clad Laminate vs. FR-4?

2025-12-18

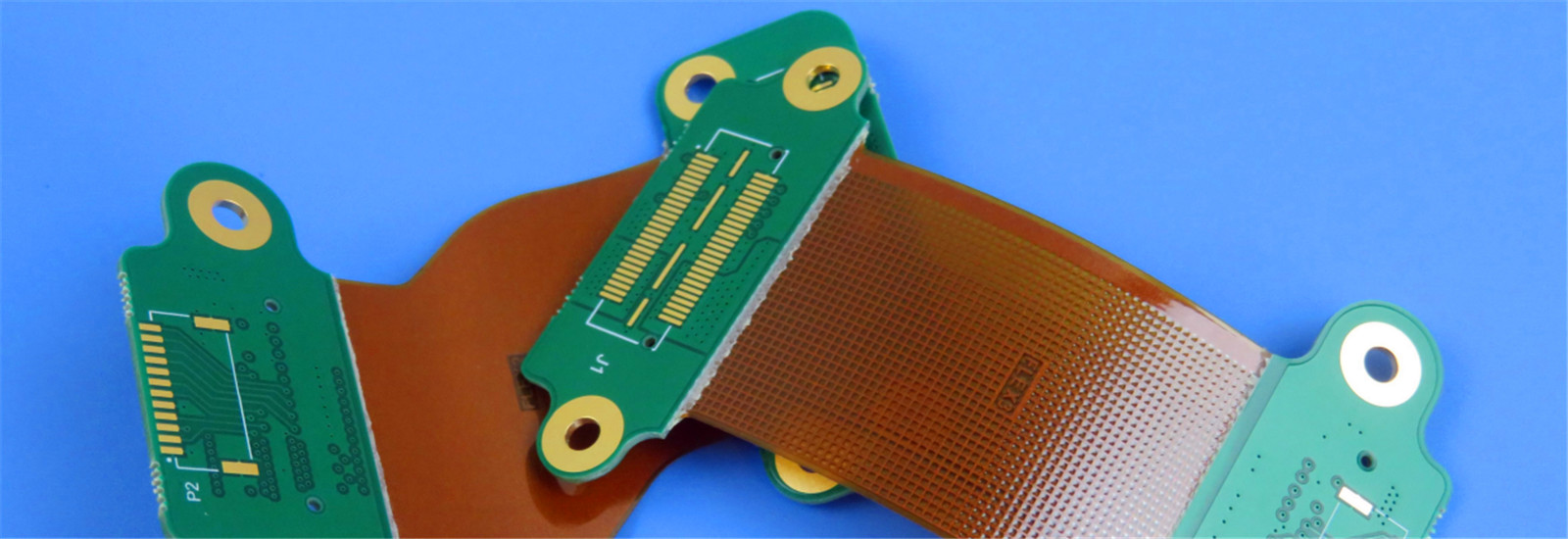

Metal clad laminates and FR-4 are two commonly used substrate materials for printed circuit boards (PCBs) in the electronics industry. They differ in material composition, performance characteristics, and application areas.

Analysis of Metal Clad Laminate and FR-4

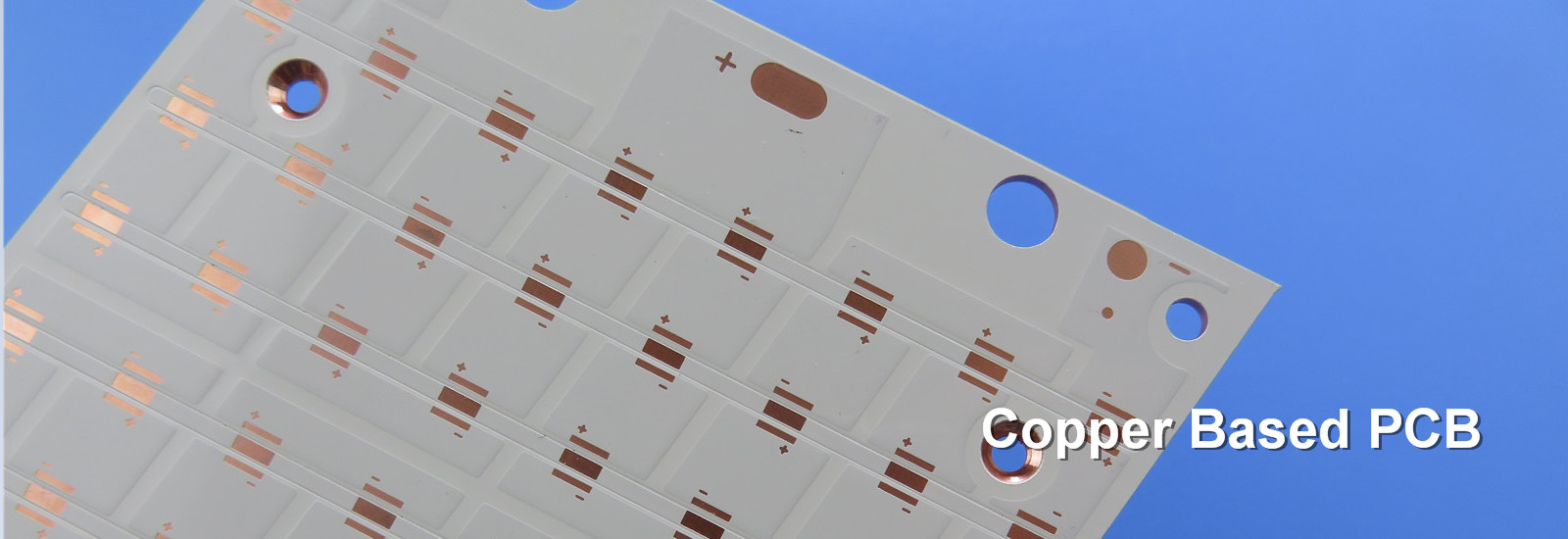

Metal Clad Laminate: This is a PCB material with a metal base, typically aluminum or copper. Its main feature is excellent thermal conductivity and heat dissipation capability, making it highly popular in applications requiring high thermal conductivity, such as LED lighting and power converters. The metal base effectively transfers heat from hotspots on the PCB to the entire board, reducing heat accumulation and improving the overall performance of the device.

FR-4: FR-4 is a laminate material that uses glass fiber cloth as the reinforcement and epoxy resin as the binder. It is the most widely used PCB substrate, favored for its good mechanical strength, electrical insulation properties, and flame-retardant characteristics, making it suitable for various electronic products. FR-4 has a flame-retardant rating of UL94 V-0, meaning it burns for a very short time when exposed to flames, making it suitable for electronic devices with high safety requirements.

Main Differences Between Metal Clad Laminate and FR-4

1. Base Material: Metal clad laminate uses metal (such as aluminum or copper) as the base, while FR-4 uses glass fiber cloth and epoxy resin.

2. Thermal Conductivity: Metal clad laminate has significantly higher thermal conductivity than FR-4, making it suitable for applications requiring effective heat dissipation.

3. Weight and Thickness: Metal clad laminate is generally heavier than FR-4 and may be thinner.

4. Processability: FR-4 is easy to process and suitable for complex multilayer PCB designs, while metal clad laminate is more challenging to process but ideal for single-layer or simple multilayer designs.

5. Cost: Metal clad laminate is typically more expensive than FR-4 due to the higher cost of metal.

6. Application Areas: Metal clad laminate is mainly used in electronic devices requiring good heat dissipation, such as power electronics and LED lighting. FR-4 is more versatile and suitable for most standard electronic devices and multilayer PCB designs.

In summary, the choice between metal clad laminate and FR-4 depends primarily on the product's thermal management requirements, design complexity, cost budget, and safety considerations. JDB PCB advises selecting materials based on the product's specific needs, as the most advanced material is not necessarily the most suitable.

------------------------------

Copyright Notice: The copyright for the above text and images belongs to the original author(s). Bicheng shares this as a repost. If there are any copyright concerns, please contact us, and we will remove the content.

View More

Mainland China's PCB Output Value to Rank First Globally in 2025, Share to Rise to 37.6%

2025-12-18

The demand for AI is driving a global expansion in Printed Circuit Board (PCB) production and the development of new manufacturing locations. Chinese manufacturers are actively establishing a presence in Thailand, while South Korean PCB companies, leveraging Samsung's longstanding operations in Vietnam, have made Malaysia a key expansion site for IC substrates in recent years. Japan is increasing investment to strengthen its ecosystem for advanced packaging and high-end PCBs, and Taiwanese PCB manufacturers have initiated a "China Plus One" strategy, shaping a new wave of production expansion.

On December 14, the Taiwan Printed Circuit Association (TPCA) and the Industrial Technology Research Institute's Industrial Economics and Knowledge Center released the "2025 Mainland China PCB Industry Dynamic Observation" and the "2025 Japan and South Korea PCB Industry Observation" reports, analyzing the industrial shifts in East Asian PCB production bases in the AI era and the expansion into new locations.

TPCA pointed out that Mainland China is the world's largest PCB production base. In 2025, the output value of Mainland Chinese companies is expected to reach $34.18 billion, a year-on-year increase of 22.3%, with the global market share rising to 37.6%, demonstrating explosive growth momentum.

Mainland Chinese manufacturers are actively promoting overseas deployment. Thailand, with its favorable investment environment and well-developed infrastructure, has become the preferred destination for Mainland Chinese PCB manufacturers' capacity relocation. TPCA stated that the current estimated production value of Mainland Chinese-funded PCB factories in Thailand accounts for about 1.7% of their total output value. Although they may face challenges in the short term, such as rising local labor costs and low initial yield rates for new factories, the globalization strategy can mitigate geopolitical risks and attract new customers and market share in the long run.

Taiwan (China) is the world's second-largest PCB production base. Mainland China was once the primary production location for Taiwanese PCB companies. In recent years, affected by geopolitical risks, Taiwanese companies have successively launched a "China Plus One" strategy, establishing new bases in Taiwan and Southeast Asia. Currently, more than ten Taiwanese-funded PCB companies, including Compeq, Zhen Ding Technology, Unimicron, Chin-Poon, and Gold Circuit Electronics, have invested and set up factories in Thailand, with many now in mass production. Tripod focuses on Vietnam, while HannStar Board and GBM, under the PSA Group, have chosen Malaysia for their plants.

TPCA stated that Taiwan's (China) semiconductor and PCB industries play crucial roles in the global AI server supply chain. Facing changes in the new Asian landscape, Taiwan (China) needs to accelerate the deepening and strengthening of its capabilities in advanced packaging, high-end technology, and material autonomy while managing geopolitical and market risks to maintain its key role in the AI era's supply chain restructuring.

Japan is the world's third-largest PCB production base. TPCA noted that the output value of Japanese-funded companies in 2024 was approximately $11.53 billion, with a global market share of about 14.4%. It is estimated that Japan's PCB industry will return to positive growth in 2025, with the total domestic and overseas output value expected to rise to $11.82 billion, reaching $12.35 billion in 2026.

Furthermore, TPCA indicated that Japan is not only relying on corporate investment to boost production capacity but also aligning with the government's recent national strategies for AI and semiconductors. Through institutionalized subsidies, dedicated funding systems, and supply chain security strategies, Japan aims to enhance its overall competitiveness in the advanced packaging and high-end PCB ecosystem.

South Korea ranks fourth in the global PCB market. TPCA reported that the total domestic and overseas output value of South Korean-funded enterprises in 2024 was approximately $7.86 billion, accounting for a 9.8% market share. The South Korean industry is expected to experience stable and moderate growth from 2025 to 2026, with projected total output values of $7.94 billion and $8.16 billion, respectively.

Regarding overseas deployment, TPCA pointed out that South Korean PCB companies, benefiting from Samsung's established supply chain in Vietnam over the years, have made Malaysia a primary expansion base for IC substrates in recent years, actively increasing BT substrate capacity to meet subsequent memory market demand. TPCA analyzed that South Korea will continue to play a significant role in memory and server platforms and maintain its strategic position in the global PCB supply chain through high-end substrate technology.

------------------------------------

Source: TPCA

Copyright Notice: The copyright for the above text and images belongs to the original author(s). We share this as a repost. If there are any copyright concerns, please contact us, and we will remove the content.

View More

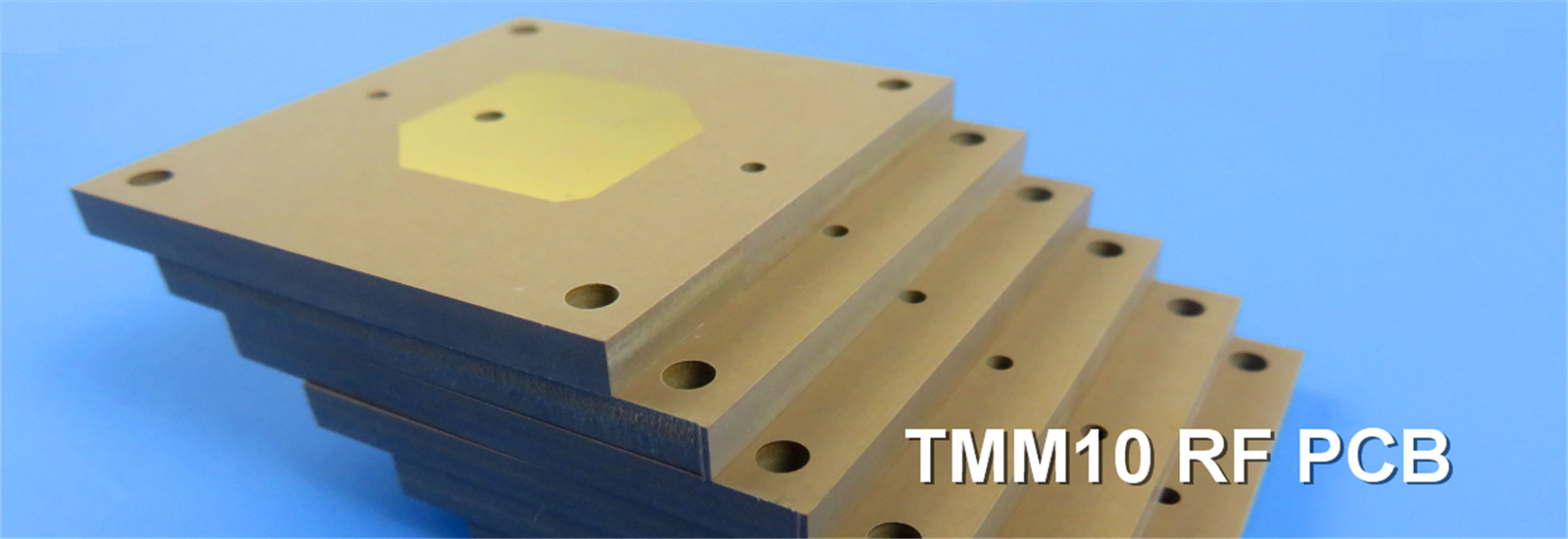

How Does RO4003C LoPro Laminate Enhance RF PCB Performance

2025-12-03

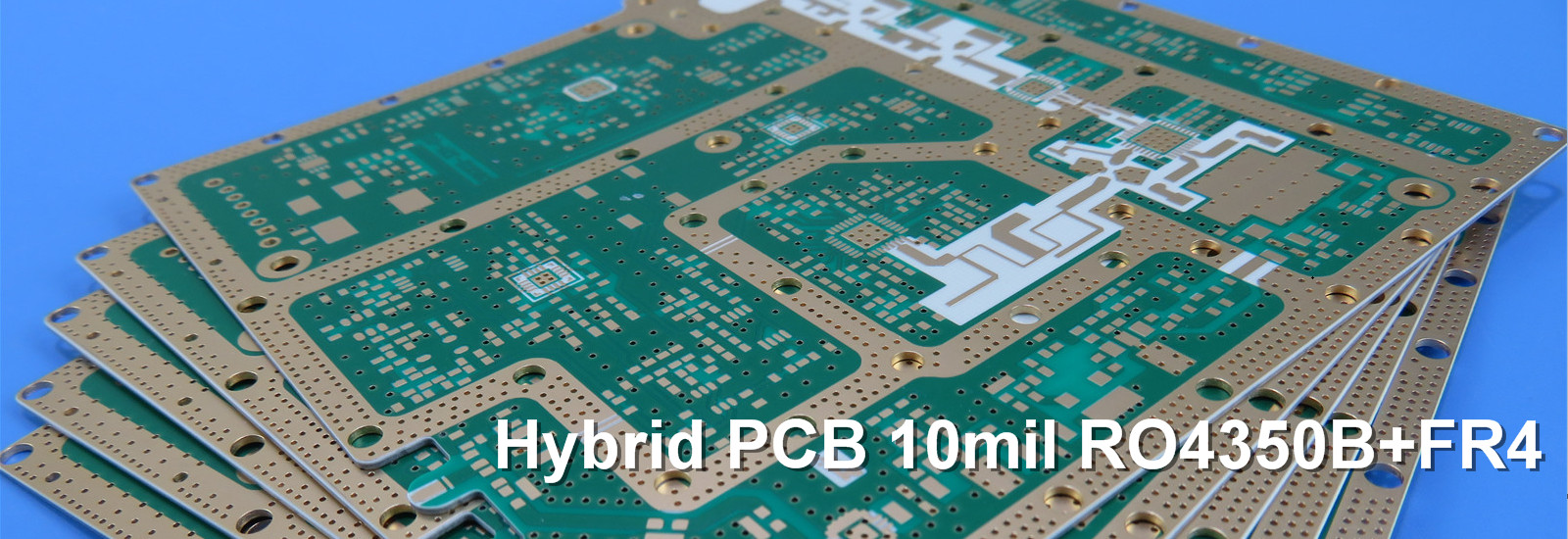

The performance of radio frequency (RF) and high-speed digital circuits is intrinsically linked to the substrate material and construction of the printed circuit board (PCB). The presented board exemplifies how advanced hydrocarbon ceramic materials can be leveraged to achieve superior signal integrity and thermal performance while maintaining compatibility with standard PCB processing techniques.

1. Introduction

As operational frequencies in communication and computing systems continue to escalate, the electrical properties of the PCB substrate become a dominant factor in system performance. Traditional FR-4 materials exhibit excessive loss and unstable dielectric constant at microwave frequencies, necessitating the use of specialized low-loss laminates. The following technical analysis focuses on a specific implementation using Rogers Corporation's RO4003C LoPro series, a material engineered to provide an optimal balance of high-frequency performance, thermal management, and manufacturability.

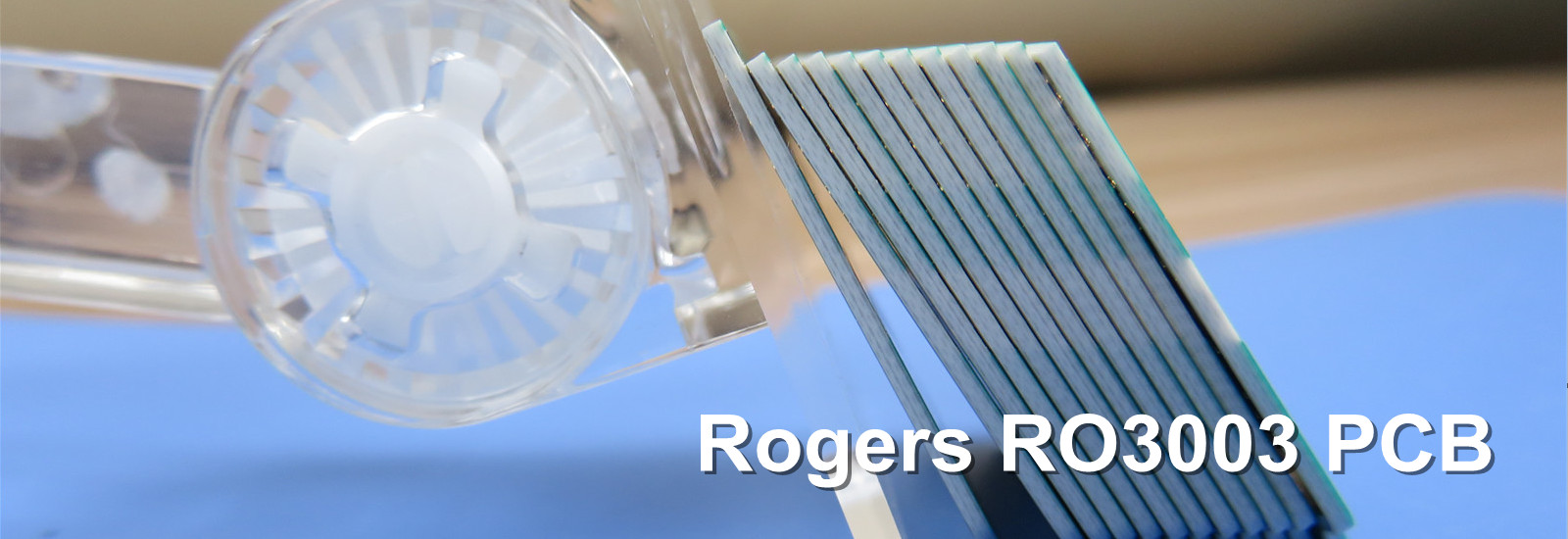

2. Material Selection: RO4003C LoPro Laminate

The core of the design is the RO4003C LoPro laminate, a hydrocarbon ceramic composite. Its selection is justified by several key characteristics:

Stable Dielectric Constant: A tight tolerance of 3.38 ± 0.05 at 10 GHz ensures predictable impedance control across the board and over varying environmental conditions.

Low Dissipation Factor: At 0.0027, the material minimizes dielectric loss, which is critical for maintaining signal strength and integrity in applications exceeding 40 GHz.

Enhanced Thermal Performance: The laminate features a high thermal conductivity of 0.64 W/m/K and a glass transition temperature (Tg) exceeding 280°C, ensuring reliability during lead-free assembly and in high-power operational environments.

Low-Profile Copper: The "LoPro" designation refers to the use of reverse-treated foil, which creates a smoother conductor surface. This reduces conductor loss and dispersion, directly improving insertion loss compared to standard electrodeposited copper foils.

A significant advantage of the RO4003C material system is its compatibility with standard FR-4 multilayer lamination and processing procedures, eliminating the need for costly via pre-treatments and thereby reducing overall manufacturing cost and complexity.

3. PCB Construction and Stack-up

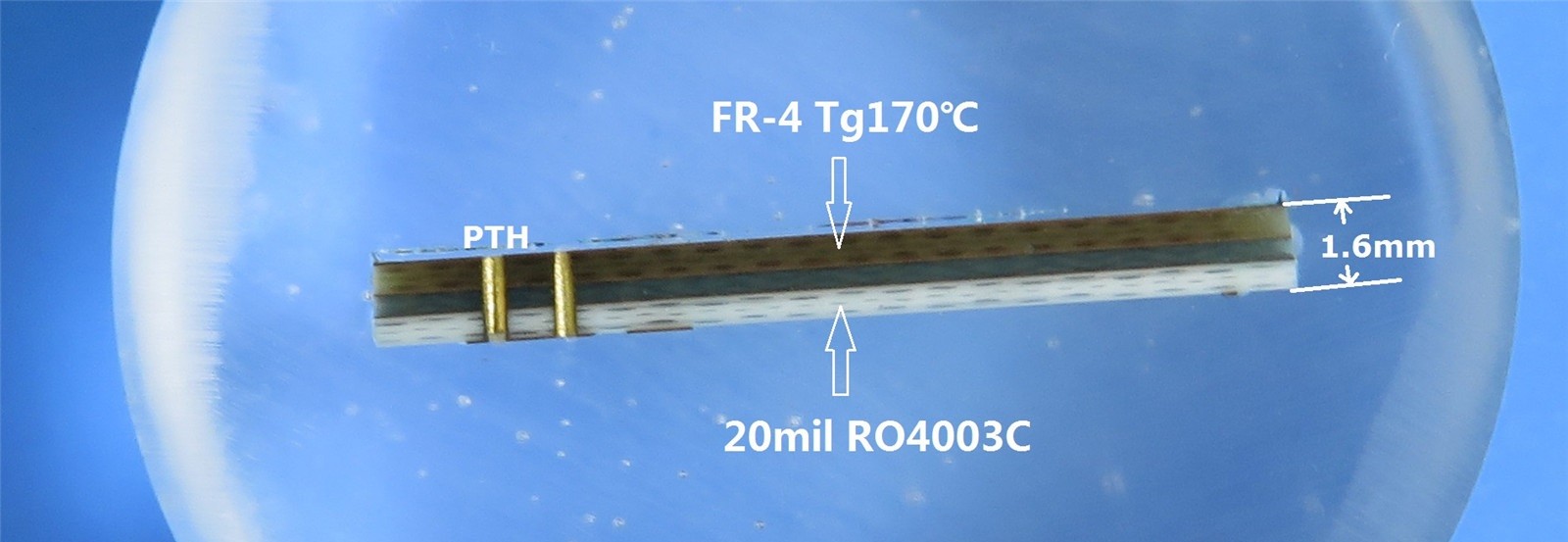

The board is a 2-layer rigid construction with the following detailed stackup:

Layer 1: 35 µm (1 oz) rolled copper foil.

Dielectric: Rogers RO4003C LoPro core, 0.526 mm (20.7 mil) thick.

Layer 2: 35 µm (1 oz) rolled copper foil.

The finished board thickness is 0.65 mm, indicating a thin-profile build suitable for compact assemblies. The construction details reflect a design optimized for high yield and performance:

Critical Dimensions: Minimum trace/space of 5/5 mil and a minimum drilled hole size of 0.3 mm demonstrate a design rule set that is readily achievable while supporting a moderate level of routing density.

Surface Finish: The specification of silver underplating with gold plating (often referred to as "hard" or "electrolytic" gold) is indicative of an RF design. This finish provides excellent surface conductivity for high-frequency currents, low contact resistance for connectors, and superior environmental robustness.

Via Structure: The board utilizes 39 through-hole vias with a plating thickness of 20 µm, ensuring high reliability for interlayer connections. The absence of blind vias simplifies the fabrication process.

4. Quality and Standards

The PCB layout data was supplied in Gerber RS-274-X format, ensuring accurate and unambiguous data transfer to the manufacturer. The board was fabricated and tested to IPC-A-600 Class 2 standards, which is the typical benchmark for commercial and industrial electronics where extended life and performance are required.

Quality Assurance: A 100% electrical test was performed post-manufacturing, verifying the integrity of all connections and the absence of shorts or opens.

5. Application Profile

The combination of material properties and construction details makes the PCB suitable for a range of high-performance applications, including:

Cellular base station antennas and power amplifiers, where low passive intermodulation (PIM) is critical.

Low-noise block downconverters (LNBs) in satellite reception systems.

Critical signal paths in high-speed digital infrastructure, such as server backplanes and network routers.

High-frequency RF identification (RFID) tags.

6. Conclusion

The analyzed PCB serves as a practical case study in the effective application of Rogers RO4003C LoPro laminate. The design leverages the material's stable electrical properties, low loss profile, and excellent thermal characteristics to meet the demands of modern high-frequency circuits. Furthermore, the fabrication specifications demonstrate that such high performance can be achieved without resorting to exotic or prohibitively expensive manufacturing processes.

View More